Square POS continues to dominate the small business market in 2025, offering a powerful free tier that makes it accessible to businesses of all sizes. Here’s everything you need to know about Square’s latest features, pricing, and whether it’s right for your business.

What’s New in Square POS for 2025

- AI-Powered Inventory Management – Square now uses machine learning to predict stock needs and automate reordering

- Enhanced Tap-to-Pay – Accept contactless payments directly on your smartphone without additional hardware

- Improved Analytics Dashboard – Real-time insights with customizable reports and forecasting

- Square Banking Integration – Instant access to funds with Square Checking and Savings

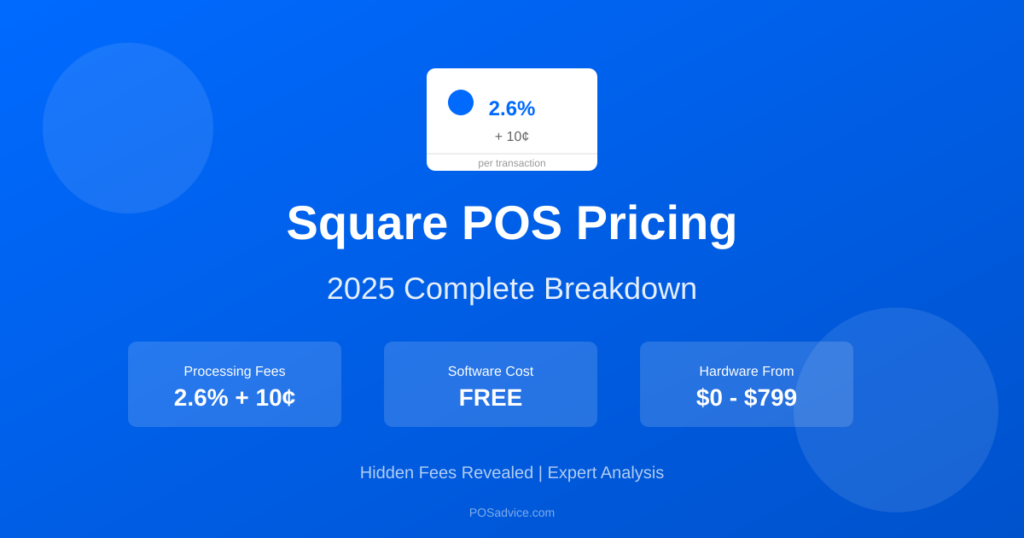

Square POS Pricing (2025)

| Plan | Monthly Cost | Processing Fee |

|---|---|---|

| Free | $0/mo | 2.6% + 10¢ |

| Plus | $29/mo | 2.5% + 10¢ |

| Premium | $79/mo | 2.25% + 10¢ |

Pros and Cons

Pros

- Free to start with no monthly fees

- Intuitive, easy-to-use interface

- Robust free features including inventory and reporting

- Excellent hardware options

- Strong ecosystem with Square Online, Payroll, Marketing

Cons

- Processing fees can add up for high-volume businesses

- Limited customization for complex businesses

- Account stability concerns for some industries

- Customer support can be slow

Our Verdict: 4.8/5

Square remains the best POS system for small businesses in 2025. Its combination of free pricing, powerful features, and ease of use makes it the go-to choice for retailers, service businesses, and pop-up shops. If you’re just starting out or want a no-commitment solution, Square should be your first consideration.

Quick Facts: General POS

Expert Tips for Choosing a POS System

Start with a Free Trial

Never commit to a POS system without testing it first. Most reputable providers offer 14-30 day free trials. Use this time to run real transactions, train your staff, and identify any workflow issues before signing a contract.

Calculate Total Cost of Ownership

The monthly software fee is just the beginning. Factor in hardware costs, payment processing fees, add-on modules, support tiers, and potential early termination fees. A "$0/month" system might cost more than a $100/month system when you add everything up.

Prioritize Integration Capabilities

Your POS should connect with your accounting software, e-commerce platform, delivery apps, and loyalty program. Poor integrations lead to manual data entry, errors, and wasted time. Ask vendors about their API and native integrations.

New to POS Systems?

Start with our quick guide for business owners

Get StartedFrequently Asked Questions

A cash register simply records sales and stores money. A POS (Point of Sale) system is a comprehensive business management tool that processes payments, tracks inventory, manages employees, generates reports, and integrates with other business software. Modern POS systems provide data-driven insights that help you make better business decisions.

POS costs vary widely. Software ranges from $0-$200+ per month. Hardware costs $500-$2,000 for a basic setup. Payment processing fees are typically 2.3%-2.9% plus $0.10-$0.30 per transaction. Consider the total cost of ownership over 3 years, including add-ons and upgrades.

Some POS systems are processor-agnostic, allowing you to choose your payment processor. Others require you to use their integrated processing. Locked-in processing can be convenient but may limit your ability to negotiate rates. Always ask about processing flexibility before committing.

Data portability varies by provider. Most systems allow you to export sales history, customer data, and inventory lists. However, the format may not be directly importable to a new system. Always ask about data export options and consider this when choosing a POS.